Future and Options trading in India have adversely

affected the retail investors. Stock Exchange of India

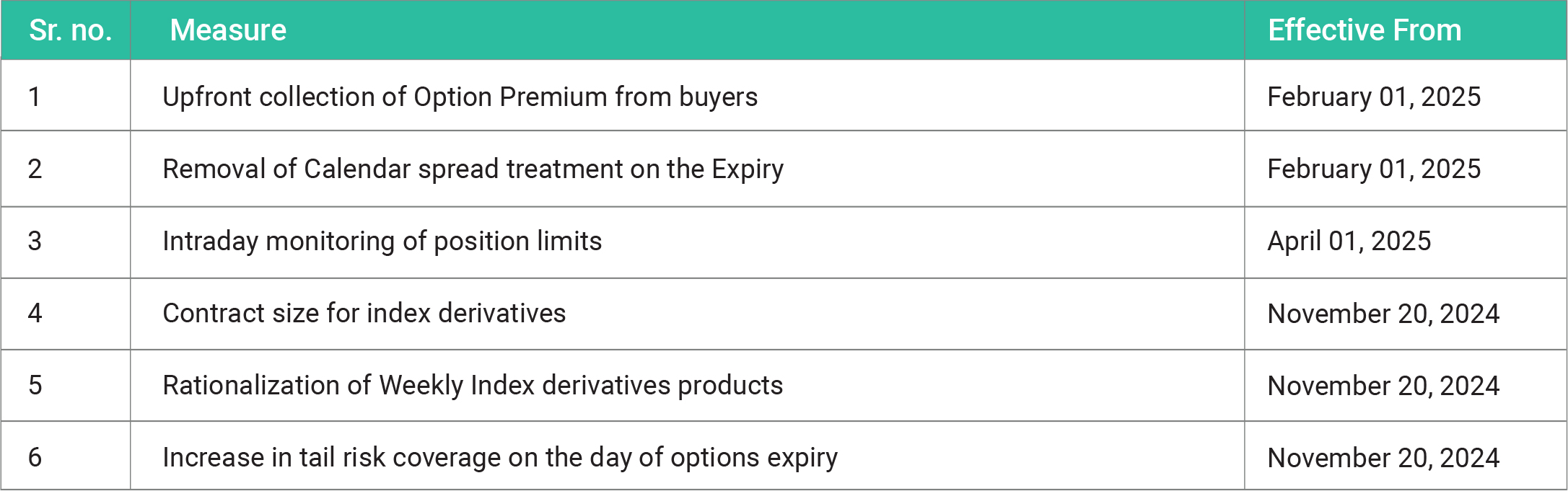

introduced new trading rules for F&O which will be

implemented from 1st October 2024. These measures

would curb the concerns about high levels of speculation

in the derivatives market where over 93% of retail traders

reportedly incurred losses in recent years, summing

around Rs.1.8 trillion. By implementing new rules and

regulations SEBI aims to enhance investor protection

and promote responsible trading practices among retail

participants. To simplify the derivatives trading rules

Sebi has made some major changes starting from

October 2024.

• Derivatives contract size is raised from Rs.5

lakhs to RS.15 lakhs, this will inhibit speculative trading

by retail investors. This new contract size will be effective

from 20th November 2024.

• Entire option premium is collected upfront from

buyers. SEBI has mandated the brokers to collect the

premium, which would prevent excessive intraday

leverage and discourage traders from holding positions

beyond their collateral.

• Limited weekly expiration of derivatives to one

benchmark index per exchange. For example, the

National Stock Exchange (NSE) may only offer weekly

expiries for either the Nifty or Bank Nifty, while the

Bombay Stock Exchange (BSE) will offer them only for

Sensex or BankEx. This change is also effective from

November 20, 2024.

• No benefits for calendar spreads on expiry day,

which means that if traders hold positions across

different expiries, they will need to maintain full margin

on expiry day, effective from February 1, 2025.

• Additional Extreme Loss Margin (ELM) of 2% is

introduced which will be applied to short options

contracts on expiry days. This margin is intended to

cover potential risks associated with increased volatility

on these days.

• Stock exchanges will monitor position limits for

equity index derivatives on an intraday basis rather than

at the end of the trading day. This measure aims to

prevent large traders from manipulating the market and

will come into effect in April 2025.

SEBI with these changes restricts the retail investor's

participation which would reduce the speculative activity

in the derivative market. The minimum contract size for

derivatives has been raised from ₹5-10 lakh to ₹15 lakh.

Many small investors with limited capital may find it

challenging to participate in derivatives trading. The new

contract size aims to deter speculative trading among

retail investors who often engage in high-risk strategies

without sufficient capital or experience. SEBI ensures

that only those with adequate financial resources and

risk tolerance participate, potentially leading to a

decrease in reckless trading behaviour. With the

reduction of weekly expiries to one per benchmark index

per exchange, retail traders will have fewer opportunities

for short-term speculative trades. This limitation may

lead to decreased intraday volatility and trading volumes.

Retail investors may shift towards longer-term

investment strategies rather than frequent trading in

derivatives due to the large contract size. The

introduction of an additional Extreme Loss Margin (ELM)

of 2% for short options on expiry days will further tighten

the capital requirements for retail traders. This measure

is intended to protect against extreme market

fluctuations but may also limit the ability of smaller

investors to maintain positions during volatile periods.

While the changes are designed to stabilize the market

and protect retail investors, they may also lead to lower

overall market volatility. This could impact trading

dynamics and reduce opportunities for profit-making

through active trading strategies.

While these measures may present immediate

challenges for retail traders, experts believe they could

lead to a healthier market environment in the long run. By

reducing excessive speculation and promoting

responsible trading practices, SEBI aims to protect small

investors from significant losses that have historically

plagued this segment. Traders and investors should

prepare for these changes and adjust their trading

strategies accordingly as these regulations come into

effect in the coming months.